How the U.S. plans to use cryptocurrency

We live in an amazing time when cryptocurrency becomes not just a digital asset, but a real pillar of the economy of entire states. It so happened that US President Donald Trump, already in his second term of office, bet on the support of the cryptocurrency community. This decision helped him to be in the White House again after the 2024 election. However, the support from cryptans was not gratuitous – Trump promised them a lot. In addition to protecting miners and freeing cryptocompanies from persecution, the key point of his program was the creation of a US cryptocurrency reserve. What is it and why is there so much noise around this idea?

The beginning of the story

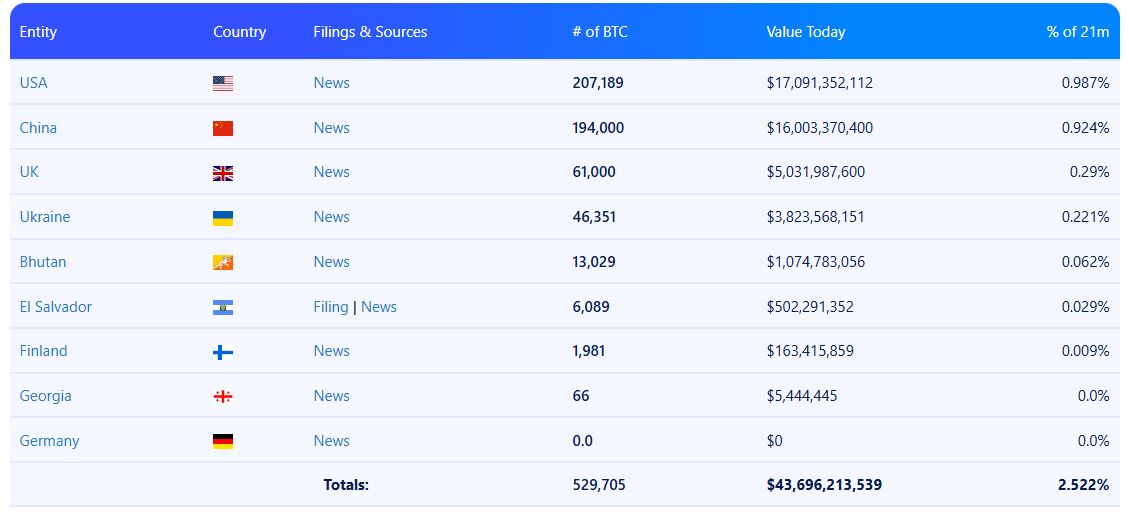

For the first time, Donald Trump spoke about plans to form a US bitcoin reserve in the summer of 2024 at the Bitcoin 2024 conference in Nashville. His speech then blew up the cryptocommunity. The president announced that if he wins, he intends to fire Securities and Exchange Commission (SEC) head Gary Gensler and permanently freeze the sale of bitcoins held by the government. Thus, every bitcoin mined or purchased by the U.S. government will be held as part of the strategic national stockpile.

How is a bitcoin reserve organized?

The idea to form a federal cryptocurrency reserve was proposed by Senator Cynthia Lummis. She drafted a bill called the BITCOIN Act of 2024. According to this plan, the reserve should count 1 million bitcoins (about 5% of the total issue). The purchase of cryptocurrency will be financed through the sale of other state assets, such as gold certificates. Moreover, the sale of bitcoins from this reserve will be frozen for the next 20 years.

The initiative was supported by many prominent representatives of the cryptosphere, including Samson Mou (CEO of Jan3 and former Blockstream employee) and Michael Saylor (ex-head of MicroStrategy). The main purpose of the reserve is to reduce the U.S. debt burden. According to supporters of the idea, investments in bitcoin will help strengthen the country’s economy and increase its prestige in the international arena.

First steps toward implementation

Already in January 2025, Trump began to act. He issued an executive order, according to which a working group on the development of the cryptoindustry was created. The group was headed by David Sachs, White House adviser on artificial intelligence and cryptocurrencies. The group was tasked with evaluating the possibility of creating a strategic digital reserve that would include cryptocurrencies seized by law enforcement agencies. The executive order also prohibited federal agencies from engaging in the business of issuing their own digital currency (CBDC).

In March 2025, another important event occurred: Trump unexpectedly announced that the cryptocurrency reserve would include not only bitcoins, but also popular altcoins such as XRP, SOL, and ADA. This announcement took many by surprise, as the original plan was to focus solely on bitcoins. After the announcement, the value of these coins skyrocketed.

Criticism and complexities

Although the idea of creating a cryptocurrency reserve looks promising, it raises a lot of questions and concerns. The main ones concern:

- Asset selection: While earlier the focus was on bitcoin, other cryptocurrencies are now on the list. This calls into question the sustainability of the whole concept.

- Political motives: There are suspicions that the inclusion of altcoins in the reserve may have been influenced by lobbyists who supported Trump in the election.

- Selection criteria: Some altcoins, such as XRP and Solana, have raised doubts about their reliability. Their inclusion in the reserve could weaken confidence in the U.S. financial system.

- Conflicts of interest: Members of the working group have their own investment portfolios, which raises questions about the impartiality of their decisions.

- Organizational challenges: It is still unclear who will manage and secure the reserve. The lack of a clear plan may make the project difficult to implement.

- Accusations of market manipulation: Peter Schiff, a prominent critic of cryptocurrencies, accused Trump of using the news about the inclusion of altcoins in the reserve for “dump and dump” schemes. In his opinion, this information could have reached insiders in advance who had time to capitalize on it.

Possible implications

If Trump succeeds in implementing his idea, it could seriously change the global dynamics of the cryptocurrency market. It is expected that the bitcoin rate will grow significantly due to massive purchases of cryptocurrency by the US authorities. However, it is worth remembering that such forecasts remain only hypotheses.

Creating a U.S. cryptocurrency reserve is an ambitious task that could transform the world of cryptocurrencies. But at the same time, it carries a lot of risks and uncertainties. It is important to realize that any major change requires careful analysis and a balanced approach. Let’s hope that the U.S. can find a balance between innovation and stability.